Internet connection and access technologyhttps://www.anacom.pt/render.jsp?contentId=55129

Barriers to subscribing to broadband Internethttps://www.anacom.pt/render.jsp?contentId=55130

Broadband usehttps://www.anacom.pt/render.jsp?contentId=55131

Use of Broadband - VoIPhttps://www.anacom.pt/render.jsp?contentId=55132https://www.anacom.pt/render.jsp?contentId=55132

Consumer satisfactionhttps://www.anacom.pt/render.jsp?contentId=55133

Customer satisfaction (by operator)https://www.anacom.pt/render.jsp?contentId=55134

Access shares and intention to switch operatorhttps://www.anacom.pt/render.jsp?contentId=55135

Note on the methodologyhttps://www.anacom.pt/render.jsp?contentId=55137

Main results

Internet connection and access technology

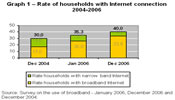

1. In December 2006, 40 per cent of Portuguese households had internet access, a 4.7 per cent increase since January 2006.

The rate of households with broadband Internet connection increased 7.8 per cent, reaching 33.8 per cent. This result is partly justified by the migration from narrow band to broadband.

Graph 1 - Rate of households with Internet connection 2004-2006

(Click here to see the full-size image)

2. About 9.7 per cent of those without Internet intend to subscribe to the service within the year.

Should the respondents' intentions come true, household Internet penetration will reach around 46 per cent by the end of 2007.

| Jan-06 | Dec-06 | |

|---|---|---|

| Intends to subscribe | 13.0 | 9.7 |

| Does not intend to subscribe | 87.0 | 90.3 |

| Total | 100 | 100 |

Base: Respondents without Internet access at home.

Source: Survey on the use of broadband - January 2006 and December 2006.

This means that, on that date, most households with a PC will have an Internet connection (in March 2006, PC-equipped household Internet penetration was already close to 80 per cent) 1https://www.anacom.pt/render.jsp?contentId=55138.

3. The main technology supporting broadband is ADSL (60 per cent of all accesses).

According to the available data, about 3.1 per cent of broadband users use third generation (3G) mobile accesses.

| Jan-06 | Dec-06 | |

|---|---|---|

| ADSL | 47.2 | 60.5 |

| Cable modem | 46.6 | 36.0 |

| 3G Card | 3.0 | 3.1 |

| Powerline | 1.3 | 0.2 |

| Other | 2.0 | 0.3 |

| Total | 100 | 100 |

Base: Respondents without Internet access at home.

Source: Survey on the use of broadband - January 2006 and December 2006.

The Powerline Communications (PLC) technology is mentioned by about 0.2 per cent of those interviewed. It should be mentioned that this offer was terminated by Onitelecom on the 3rd quarter of 2006.

Barriers to subscribing to broadband Internet

4. The main barrier to subscribing to the Internet is the lack of interest or the fact that it is considered superfluous (47.1 per cent, 8.8 per cent more than in January). The second main barrier to Internet access is the lack of a computer (33 per cent).

About 9.7 per cent of those interviewed consider that price is the main barrier to Internet access.

It is only natural that the relative importance of these factors increases with Internet penetration.

| Jan-06 | Dec-06 | |

|---|---|---|

| Does not need / has no interest | 38.3 | 47.1 |

| Has no computer | 34.0 | 33.3 |

| Its price is to high | 8.6 | 9.7 |

| Has no time | 3.5 | 2.0 |

| Has access at other locations | 2.5 | 4.6 |

| Has no geographical coverage | 2.2 | 0.9 |

| Other | 10.9 | 2.5 |

| Total | 100 | 100 |

Base: Respondents without Internet access at home.

Source: Survey on the use of broadband - January 2006 and December 2006.

5. The main reasons that prevent migration from narrow band to broadband continue to be ''Does not need / has no interest in it'' and ''Its price is to high''.

The answer ''broadband access at work'' recorded an 8.5 per cent answer decrease.

| Jan-06 | Dec-06 | |

|---|---|---|

| Does not need / has no interest in it | 30.9 | 30.4 |

| Its price is to high | 25.6 | 27.6 |

| Due to geographical coverage issues | 12.8 | 15.3 |

| Is satisfied with current service | 10.1 | 9.0 |

| Has broadband Internet access at work | 15.8 | 7.3 |

| Other answers | 2.6 | 7.2 |

| Has no time | 2.2 | 3.1 |

| Total | 100 | 100 |

Base: Respondents that have narrow band Internet access.

Source: Survey on the use of broadband - January 2006 and December 2006.

It should be mentioned that broadband users are mostly youngsters, students, technical or scientific professionals, with higher education. i.e., there are factors of a demographic, socio-economic and cultural nature that may have a determinant impact on having broadband.

Broadband use

6. Almost all of the respondents with broadband Internet use it to ''search for information'' (96.4 per cent).

The use of e-government-related applications and e-commerce increased considerably - between 3 and 5 per cent.

''Music, game and movie downloads'' decreased 11.8 per cent.

| Jan-06 | Dec-06 | |

|---|---|---|

| Search for general information | 96.4 | |

| Search for study - or investigation - related issues | 91.0 | 89.7 |

| Access news | 80.6 | |

| Music, game and movie downloads | 66.4 | 54.6 |

| Entertainment, such as online games or videos | 52.1 | 51.6 |

| Filing tax statements | 39.2 | 44.4 |

| Operating bank accounts | 38.4 | 40.9 |

| Service payments | 37.0 | 38.0 |

| Online shopping | 27.2 | 30.0 |

Base: Respondents with broadband Internet access.

Source: Survey on the use of broadband - January 2006 and December 2006.

| Jan-06 | Dec-06 | |

|---|---|---|

| Yes | 14.0 | 15.3 |

| No | 86.0 | 84.7 |

| Total | 100 | 100 |

Base: Respondents with broadband Internet access.

Source: Survey on the use of broadband - January 2006 and December 2006.

8. Skype is the most used software to make computer voice calls.

| Jan-06 | Dec-06 | |

|---|---|---|

| Skype | 61.9 | 69.8 |

| Netcall | 6.2 | 6.9 |

| IOL Talki | 11.8 | 6.5 |

| VoIP Buster | 5.2 | 5.6 |

| Other answers | 6.6 | 0.6 |

| NR/NA | 8.3 | 10.7 |

| Total | 100 | 100 |

Base: Respondents that use the Internet to make voice calls

Source: Survey on the use of broadband - January 2006 and December 2006

Consumer satisfaction

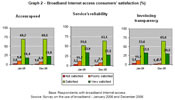

9. As for the consumers' evaluation of broadband Internet access, satisfaction increased regarding all of the service's items. The rate of those interviewed answering that the broadband access service did not correspond to their expectations fell from 8.8 per cent in January 2006 to 6.6 per cent in December 2006.

91.4 per cent of users are satisfied or very satisfied with the access speed, which is a 3.8 per cent increase regarding January 2006. It should be mentioned that during this period the main operators doubled their main offers' download speeds.

Concerning the service's reliability, 90.6 per cent of broadband customers are satisfied or very satisfied, a 5.1 per cent increase compared to the previous survey. However, the number of those interviewed that were ''very satisfied'' with the service decreased 6.4 per cent.

Invoicing transparency registered a 9.4 per cent increase in positive assessments (95.1).

Graph 2 - Broadband Internet access consumers' satisfaction (%)

(Click here to see the full-size image)

Customer satisfaction (by operator)

10. Regarding satisfaction with the access speed, all the main operators presented very high satisfaction levels.

The highlight goes to Cabovisão, Clix and Netcabo, with 96.5, 93.1 and 91.7 per cent of positive evaluations.

| Sapo | Clix | Oni | Net-cabo | Cabo-visão | |

|---|---|---|---|---|---|

| Not satisfied | 3.1 | 1.1 | 1.3 | 1.0 | 0.0 |

| Poorly satisfied | 8.2 | 5.7 | 10.1 | 7.4 | 3.5 |

| Satisfied | 69.4 | 61.3 | 69.8 | 68.6 | 72.8 |

| Very satisfied | 19.3 | 31.8 | 18.9 | 23.1 | 23.7 |

| Total | 100 | 100 | 100 | 100 | 100 |

Base: Respondents with broadband Internet access

Source: Survey on the use of broadband - January 2006 and December 2006

| Sapo | Clix | Oni | Net-cabo | Cabo-visão | |

|---|---|---|---|---|---|

| Not satisfied | 3.1 | 0.4 | 4.3 | 2.5 | 0.8 |

| Poorly satisfied | 7.5 | 4.6 | 7.4 | 10.5 | 4.0 |

| Satisfied | 59.3 | 60.2 | 51.9 | 63.8 | 73.2 |

| Very satisfied | 30.1 | 34.9 | 36.4 | 23.2 | 22.0 |

| Total | 100 | 100 | 100 | 100 | 100 |

Base: Respondents with broadband Internet access

Source: Survey on the use of broadband - January 2006 and December 2006

Netcabo had 13 per cent of negative evaluations. It is followed by Oni and Sapo, with 11.7 and 10.6 per cent of negative evaluations.

12. More than 90 per cent of those interviewed consider that broadband invoicing is clear.

Netcabo customers are those less satisfied with invoicing transparency (7.4 per cent of negative evaluations).

| Sapo | Clix | Oni | Net-cabo | Cabo-visão | |

|---|---|---|---|---|---|

| Not satisfied | 1.8 | 0.4 | 2.6 | 1.7 | 0.3 |

| Poorly satisfied | 3.5 | 3.7 | 1.3 | 5.7 | 2.2 |

| Satisfied | 62.1 | 57.6 | 64.3 | 67.8 | 71.9 |

| Very satisfied | 32.6 | 38.4 | 31.8 | 24.9 | 25.7 |

| Total | 100 | 100 | 100 | 100 | 100 |

Base: Respondents with broadband Internet access

Source: Survey on the use of broadband - January 2006 and December 2006

13. PT Group companies provide broadband Internet access to 66.9 per cent of those interviewed in this survey.

The second largest operator is Cabovisão, with a 13.9 share.

| Dec-06 | |

|---|---|

| Sapo | 41.9 |

| Netcabo | 24.0 |

| Cabovisão | 13.9 |

| Clix | 9.4 |

| Oni | 5.6 |

| TVTel | 1.5 |

| Telepac | 1.0 |

| Other | 2.7 |

| Total | 100 |

Source: Survey on the use of broadband - January 2006 and December 2006

14. There was a considerable decrease in the intentions to changing operator in the next 12 months: 81 per cent of broadband Internet access customers say that they do not intend to change operator. In January they were 71.1 per cent.

| Dec-06 | |

| Sapo | 41.9 |

| Netcabo | 24.0 |

| Cabovisão | 13.9 |

| Clix | 9.4 |

| Oni | 5.6 |

| TVTel | 1.5 |

| Telepac | 1.0 |

| Other | 2.7 |

| Total | 100 |

Base: Respondents with broadband Internet access

Source: Survey on the use of broadband - January 2006 and December 2006

15. About 22.2 per cent of broadband Internet access customers were already customers of another operator.

| Jan-06 | Dec-06 | |

| Its was always the current provider | 78.0 | 77.8 |

| Already had other providers and changed to this one | 22.0 | 19.8 |

| Had other providers, gave up and subscribed to the current one afterwards | 2.4 | |

| Total | 100 | 100 |

Base: Respondents with broadband Internet access

Source: Survey on the use of broadband - January 2006 and December 2006

Note on the methodology:

Survey on the use of broadband: December 2006

The universe defined for this survey was made up of users of both genders, 15 years old or older, living in Mainland Portugal and in the Autonomous Regions of Madeira and the Azores. The selection of interviewees referred to the method of gender and age, education and occupation quota. The sample was stratified by region and habitat. A total of 8676 telephone interviews were conducted, including 3036 interviews to broadband users, guaranteeing a maximum error of 1.8% for the results concerning broadband users (for a significance level of 95%).

The fieldwork and handling of data was made by METRIS GFK between 1 November 2006 and 21 December 2006.

Survey on the use of broadband: January 2006

The universe defined for this survey was made up of users of both genders, 18 years old or older, living in Mainland Portugal and in the Autonomous Regions of Madeira and the Azores. The selection of interviewees referred to the method of gender and age, education and occupation quota. The sample was stratified by region and habitat. A total of 4225 telephone interviews were conducted, including 1099 interviews to broadband users, guaranteeing a maximum error of 2.96% for the results concerning broadband users (for a significance level of 95%).

The fieldwork and handling of data was made by TNS EUROTESTE between 19 December 2005 and 23 January 2006.

Survey on the use of broadband: December 2004

The universe defined for this survey was made up of users of both genders, 18 years old or older, living in Mainland Portugal and in the Autonomous Regions of Madeira and the Azores. The sample size was defined in order to guarantee a maximum error of 4% (for a significance level of 95%). The sample was stratified by region and habitat. 4711 interviews were conducted, including 794 interviews to broadband users. The survey method was the (CATI) telephone interview.

The fieldwork and handling of data was made between 19 October 2004 and 13 December 2004 and was conducted by INDEG /ISCTE.

---

1 It should be mentioned that, according to INE (National Statistical Institute), in March 2005, about 45 per cent of Portuguese households had a computer.