ANACOM believes that alternative ways to adapt the methodology for calculating CLSU for 2014 may be weighted.

Taking into account the constrains identified to calculate CLSU for 2014, that is: (i) the fact that the methodology for calculating CLSU was developed on a year-on-year basis and that MEO is entitled to be compensated for the US provision for a part of that year only; and (ii) the fact that the calculation methodology determines CLSU in an integrated manner, whereby there is an interconnection between the FTS and PPP components, and it is necessary to determine a different value for compensation purposes for the provision of US of each component - FTS and PPP -, it is deemed that the creation of two completely separate models, one to calculate the FTS component and the other to calculate the PPP component, could be weighted.

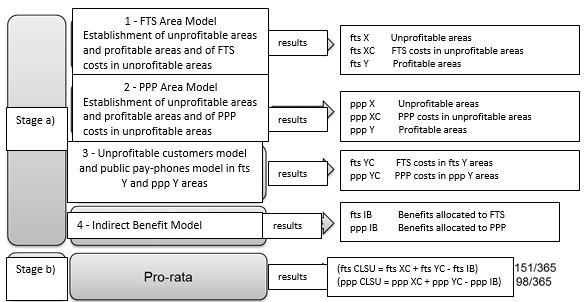

It is noted that, in the methodology approved by ANACOM, the FTS and PPP component is treated in an integrated way in the calculation of unprofitable areas and in the calculation of indirect benefits. Unprofitable customers living in profitable areas and PPP in profitable areas are determined in separate, but on the basis of the results of the identification of profitable areas and unprofitable areas.

In this separation approach (approach 4) there is complete autonomy in the calculation of annual CLSU for the FTS component and for the public pay-phones component, a pro rata being subsequently applied so that the exact value of CLSU for the period during which MEO remained as the USP prior to the tender designation procedure is achieved.

This approach would require large adjustments to the current methodology, so as to exclude in the calculation of net costs for the FTS component (to identify unprofitable areas) all information concerning public pay-phones (revenues, costs and operational data). Values concerning public pay-phones would also be calculated in separate, integrating in the public pay-phones model data concerning public pay-phones in all areas, whether or not they are profitable.

The determination of CLSU for unprofitable customers in profitable areas, and for retired persons and pensioners would be performed autonomously, so in those situations the methodology would not require any adjustment.

It is deemed that, from an operational perspective, this adaptation is feasible; however, it would have the drawback to make it harder to avoid the double counting of costs, a situation which ANACOM acknowledges in its methodology approved in 09.06.2011, where it is mentioned that “(...) costs associated to public payphones in unprofitable areas have been entered in the accounts of the fixed telephone service access component in order to avoid double counting such costs”.

As regards the indirect benefit model, it is deemed that their allocation to the FTS component or to the PPP component should take place in compliance with MEO’s proposals for each of the benefits, that is, in the case of corporate reputation and brand enhancement, the value obtained should be distributed according to the proportion of the number of unprofitable accesses for each of these components compared to the range of unprofitable accesses, in the cases of ubiquity and mailing, values should be fully allocated to FTS and in the case of advertising in public pay-phones, values should be fully allocated to that component.

Regulation fees would be the exception to MEO’s proposal, as it is deemed that they should be fully allocated to FTS, bearing in mind that the value of the “regulation fees” indirect benefit results from the difference obtained when calculating the regulation fee due by the USP taking or not into account US revenues associated to reformed persons and pensioners.

Based on adjustments described above in the methodology for calculation of CLSU, net costs for each of the US components would then be separately determined for the whole of 2014.

The CLSU value associated to FTS for the period between 1 January 2014 and 31 May 2014 would be achieved by multiplying the value calculated for FTS for 2014 by 151/365.

The CLSU value associated to PPP for the period between 1 January 2014 and 8 April 2014 would be achieved by multiplying the value calculated for PPP for 2014 by 98/365.

To allow a better understanding of this approach, the different CLSU calculation stages are illustrated below.

Figure 2 - Separation approach to determine CLSU associated to FTS and public pay-phones

Source: ANACOM

In addition, in the scope of approach 4 described above, another approach (approach 5) could be weighted based on an separate calculation of the FTS and PPP components, but where that calculation is performed only for the specific period for which FTS and PPP CLSU values are intended to be obtained, thus being separately determined:

- CLSU incurred by MEO up to 31.05.2014 for the FTS component;

- CLSU incurred by MEO up to 08.04.2014 for the PPP component.

In this approach, CLSU calculation would use operational and financial indicators for the referred periods of time, and in case average values based on data for a one-year period were used, the demonstration that these values would not differ significantly from average values associated to periods concerned would be required.