The risk-free interest rate reflects the rate of return on risk-free assets. In financial and regulatory practice, treasury bonds are generally considered to a reliable indicator and good parameter for reflecting an absence of risk. A similar position is included in the IRG’s PIBs with respect to the risk-free interest rate (PIB 6 1).

In the previous regulatory period (2009-2011), as a result of the determination of 2010, the risk-free interest rate was initially calculated by using 10-year T-bonds issued by the Portuguese State (series with monthly observations, corresponding to the two years preceding the determination period - 2007 and 2008).

The development of the international financial crisis caused great instability in financial markets, namely at the level of sovereign debt, and this led to the atypical behaviour of the implicit interest rate of national T-bonds. In the opinion of this Authority, this raised the question whether it was reasonable to use T-bonds as proxy for the risk-free interest rate indicator. This situation resulted in the review of this parameter in 2011, and ODP’s implicit rates (yields) were then used, between 2010 and 2011, from the selected set of countries (Belgium, Spain, France, Ireland, Italy and Portugal) on which the determination of 2010 was based, that were part of the same currency area.

At the present time, the macroeconomic environment is not too distant from the scenario that led ICP - ANACOM to consider that interest rates implicit in Portuguese T-bonds could hardly be deemed to be a good proxy for the risk-free interest rate.

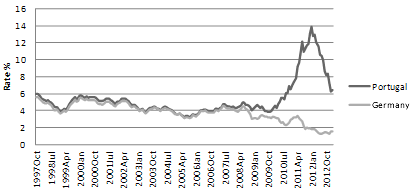

Moreover, comparing the behaviour of Portuguese bonds and that of German bund (a reference in the Euro zone), it is clear that, up to mid-2007 (see chart 1), both bonds show a very similar behaviour, and in the last few years, the gap between the referred implicit rates has widened, and its variance, that is, the difference compared to the average rate, has increased, no longer being a value around zero.

Chart 1 - Portuguese T-bonds vs. German Bund

Source: European Central Bank

In the light of the above, some alternative approaches are now presented for the calculation of the risk-free interest rate, considered in the Baker Tilly report and also resulting from internal analysis.

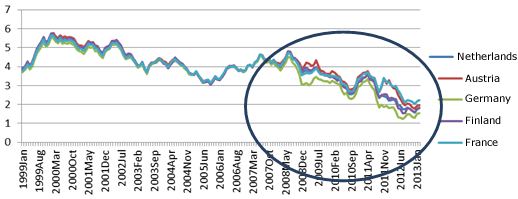

BT’s report suggests the possibility of using German bonds as representative of risk-free rates. However, in the light of the current financial crisis, the use of German bonds may not be the most appropriate solution, given that German government bonds had shown a behaviour that is significantly different from the historical average (see chart 2), which indicates a possible “refuge” effect due to the uncertainty that prevails in financial markets.

In this respect, it should be recalled that the German State has issued government debt at extremely low interest rates, in some cases even negative rates, which likely makes the exclusive use of this source to compute the risk-free interest rate a less robust option.

Chart 2 – German Bund

Source: European Central Bank

Na alternative approach, according to BT’s report, would be to use the average of implicit rates (monthly observations - two years) of 10-year bonds of main Euro Zone countries with AAA-rating (Austria, Germany, Finland, France, the Netherlands and Luxembourg).

The choice of this approach allows an alternative proxy for the risk-free interest rate; nevertheless, as referred in the case of Germany, bonds for any of the AAA countries, in the most recent observations, show an atypical behaviour compared to the historical average (see chart 3), indicating also a possible “refuge” effect due to the uncertainty that prevails in financial markets.

Chart 3 – Interest rates for countries with AAA-rating

Source: European Central Bank

In this sense, the choice for this approach could also underestimate the value of the risk-free interest rate and consequently that of the cost of capital rate, and given that the appropriate cost of capital must be computed so as to maintain the correct incentive to investment, this approach may not be the most adequate.

In the alternative, according to BT, a more robust approach than those presented hitherto could be the consideration of a composite of Euro Zone countries. This approach has the advantage of considering all countries of the Euro zone, with a broader scope and preventing any observations that are over-influenced by current macroeconomic constraints.

Taking into account the above-mentioned range of alternatives, the definition of the methodology for opting for the best proxy for the risk-free interest rate is based on two main aspects: (i) the relevant market and (ii) the maturity and type of series:

(i) Relevant market: Taking into account the current macroeconomic context in Portugal, and given that it is not possible to take as reference the government bond yields, as referred earlier, the best alternative to calculate the risk-free interest rate would be to consider the money market in which the Portuguese economy is integrated, that is, the Euro zone. As such, the best proxy for the risk-free interest rate is obtained through the average of implicit rates of ODP’s of countries that make up the Euro zone, weighed by the respective GDP.

(ii) Maturity and type of series: The maturity should be assessed according to the return expected by shareholders, the average period of depreciation of PTC’s assets and the regulatory period. In the previous determination, a 10-year maturity was taken into account, and that view is maintained for this determination also. As regards the type of series, that is, whether it should be based on historical observations or on current observations (observations of the day), and also the frequency of observations to be considered (monthly or quarterly) - it is deemed that, for regulatory purposes - and bearing in mind that volatility is intended to be minimised and that the rates observed on a particular day may contain distortions, which would be smoothed out in a historical series - the series to be used should be historical, covering a relatively long time period, for which purpose a period of two years is deemed to be appropriate, as referred to in the previous determination. As regards the frequency of observation, it is noted that the use of monthly series has advantages over quarterly series, allowing: (i) greater detail of the sample considered, and (ii) mitigating errors in the calculation of the series average, thus the use of a series based on monthly observations is considered appropriate, just as in the previous determination.

For ease of reference, it is noted that recent regulatory decisions are in generally in line with the methodological approach intended to be followed (see table 4).

|

Regulatory body |

Financial instrument |

Maturity |

Series |

|

IBPT |

Belgian bonds |

10 years |

3 years |

|

CMT |

Spanish bonds |

10 years |

6 months, daily observations |

|

Arcep |

Spot yield 15/12/2011 |

10 years |

N/A |

|

ComReg |

Spot yield average (02/07/2007) of Irish bonds + regulatory precedents |

10 years |

N/A |

|

Agcom |

Spot yield |

10 years |

N/A |

|

Ofcom |

Spot yield |

5 years |

N/A |

|

ERSE |

Bonds of five Euro Zone countries with AAA-rating |

10 years |

3 years |

Source: Website of the respective regulators and BT report

N/A - Not applicable

Methodology to be applied from 2012

In the light of the preceding points, the risk-free interest rate must be computed based on the GDP weighted average, (source: Eurostat) of the respective country, of implicit rates (yields) of 10-year T-bonds, of all Euro zone countries (historical series, based on monthly observations during the two years preceding the year of decision - source: European Central Bank).

1 The IRG considers that T-bonds provide a reliable parameter that can be used as a good proxy for the risk-free interest rate. It is likewise stressed that certain selection criteria must be taken into account, with respect to the maturity, the period of the data series and the market where the company operates.