Specifically as regards the calculation of the risk-free interest rate parameter, CTT considered a value of 10.13%, by reference to the average implicit interest rate of 10-year government bonds.

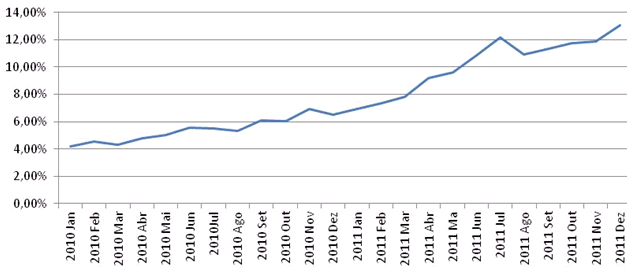

It should be taken into account that 2011 was marked by a high macro-economic instability, with repercussions at the level of implicit interest rates of sovereign debt of European countries in general and Portugal in particular.

In fact, in the course of 2011, the Portuguese State only issued 10-year government bonds once1, and in any case, the financing rate resulting from that operation was clearly and substantially lower than the value reached by CTT.

Moreover, still in 2011, the Portuguese State agreed on a program of financial assistance with international organizations2, which strongly constrains the representativeness of interest rates of 10-year government bonds, implied in transactions of this debt instrument in the secondary market.

Table 2 - Evolution of 10-year government bonds (2010-2011)

Source: European Central Bank

In this sense, ICP-ANACOM takes the view that, in the current macro-economic context, there are no grounds for considering that the value of the risk-free interest rate parameter, used in the calculation of the cost-of-capital rate for regulatory purposes, may be deducted from observations of the interest rate implicit in Portuguese government bonds.

As Portugal is part of a Monetary Union, it could be assumed that the best proxy for the value of the risk-free interest rate could be inferred from sovereign debt bonds of Member States of the Euro Area that are deemed to be the safest.

The following tables show (for 2011) the value of interest rates implicit in 10-year government bonds of the German State and of States holding at the time the highest credit rating (AAA).

|

Período |

(%) |

|

2011 January |

3.02% |

|

2011 February |

3.20% |

|

2011 March |

3.21% |

|

2011 April |

3.34% |

|

2011 May |

3.06% |

|

2011 June |

2.89% |

|

2011 July |

2.74% |

|

2011 August |

2.21% |

|

2011 September |

1.83% |

|

2011 October |

2.00% |

|

2011 November |

1.87% |

|

2011 December |

1.93% |

|

Average |

2.61% |

Source: European Central Bank

|

Period |

Percentage (%) |

||||||

|

Austria |

Germany |

Finland |

France |

Luxemburg |

Holland |

Average |

|

|

2011 January |

3.54 |

3.02 |

3.27 |

3.44 |

3.30 |

3.23 |

3.30 |

|

2011 February |

3.68 |

3.20 |

3.41 |

3.60 |

3.45 |

3.41 |

3.46 |

|

2011 March |

3.68 |

3.21 |

3.45 |

3.61 |

3.47 |

3.42 |

3.47 |

|

2011 April |

3.76 |

3.34 |

3.57 |

3.69 |

3.58 |

3.65 |

3.60 |

|

2011 May |

3.53 |

3.06 |

3.32 |

3.49 |

3.29 |

3.40 |

3.35 |

|

2011 June |

3.43 |

2.89 |

3.29 |

3.43 |

3.15 |

3.28 |

3.25 |

|

2011 July |

3.35 |

2.74 |

3.16 |

3.40 |

3.03 |

3.17 |

3.14 |

|

2011 August |

2.84 |

2.21 |

2.68 |

2.98 |

2.59 |

2.68 |

2.66 |

|

2011 September |

2.64 |

1.83 |

2.35 |

2.64 |

2.27 |

2.34 |

2.35 |

|

2011 October |

2.92 |

2.00 |

2.51 |

2.99 |

2.37 |

2.46 |

2.54 |

|

2011 November |

3.36 |

1.87 |

2.54 |

3.41 |

2.31 |

2.45 |

2.66 |

|

2011 December |

3.10 |

1.93 |

2.52 |

3.16 |

2.27 |

2.38 |

2.56 |

|

Average |

3.32 |

2.61 |

3.01 |

3.32 |

2.92 |

2.99 |

3.03 |

Source: European Central Bank

If CTT's calculation of the risk-free interest rate were to be updated, by replacing only the value of the risk-free interest rate parameter for values resulting from tables 3 and 4 above, all other things being equal, the result of the calculation of the cost-of-capital rate would then range between 11.43% and 12.02%, which is substantially lower than the 21.97% submitted originally (vide table 5).

|

Parameters |

CTT's Proposal |

Risk-free |

Risk-free |

|

| Risk-free interest rate |

10.13% |

2.61% |

3.03% |

|

|

Gearing |

1.43% |

1.43% |

1.43% |

|

| Tax rate |

29.00% |

29.00% |

29.00% |

|

|

Beta |

0.89 |

0.89 |

0.89 |

|

| Risk premium |

6.28% |

6.28% |

6.28% |

|

| Debt premium |

0.50% |

0.50% |

0.50% |

|

| Cost of equity |

15.72% |

8.20% |

8.62% |

|

| Pre-tax CMPC |

21.97% |

11.43% |

12.02% |

|

(a) - Average of interest rates of 10-year German Bund for 2011 - Table 3.

(b) - Average of interest rates of 10-year bonds of Euro-zone countries with the highest credit rating (AAA) - Table 4.

Moreover, ICP-ANACOM takes the view that parameters used in the calculation of CTT’s cost-of-capital rate for regulatory purposes may be classified as parameters inherent to the activity and structure of the regulated operator (beta, gearing and debt premium), or as context parameters that are exogenous to the regulated operator (risk premium, risk-free interest rate and tax rate).

As such, and in order to maintain regulatory consistency, ICP-ANACOM is of the opinion that the recent final draft decision on the cost of capital applied to PT Comunicações, S. A. (PTC) and respective draft decision3 may serve as a basis for determining the values of context parameters (risk premium, risk-free interest rate and tax rate) to be used in the regulation of the postal sector, given that the reference period, context and country of operation are all the same.

If parameters concerning the macro-economic context were replaced for values also used for regulatory purposes in the telecommunications sector, the calculation of CTT's cost of capital would result in a 14.77% rate (vide table 6).

|

Parameters |

ANACOM Decision |

| Risk-free interest rate |

5.36% |

|

Gearing |

1.43% |

| Tax rate |

29.00% |

|

Beta |

0.89 |

| Risk premium |

5.86% |

| Debt premium |

0.50% |

| Cost of equity |

10.58% |

| Pre-tax CMPC |

14.77% |

Source: ICP-ANACOM calculation

It must be stressed that this decision applies only to the 2011 period, as this Authority is preparing a broad methodology review of the cost of capital issue for regulatory purposes, a consultation on this matter being expected to be published soon.

1 Available at Obrigações do Tesouro - Leilões de Obrigações do Tesourohttp://www.igcp.pt/gca/?id=80.

2 Available at: Documentos Oficiais - Memorandoshttp://www.portugal.gov.pt/pt/os-ministerios/primeiro-ministro/secretario-de-estado-adjunto-do-primeiro-ministro/documentos-oficiais/memorandos.aspx.

3 Draft final decision on the revision of calculation of PTC cost of capital rate applicable to 2011 - EC notificationhttps://www.anacom.pt/render.jsp?contentId=1132426.