Broadband and broadcasting markets

Markets of voice call termination on individual mobile networks

Broadband and broadcasting markets

Several developments occurred during 2010, with regard to the provision of broadband services, with significant impact in terms of the retail and wholesale markets and confirming a number of observed trends. These include, in addition to the tender referred to in section 4.1, the following aspects:

- proliferation of bundled offers, especially triple-play bundles, which are now available from major operators and service providers in the market;

- expansion of mobile broadband, especially supported on data transmission cards connected to personal computers;

- impact of the e.iniciativas programmes launched by the Government, especially in terms of increasing the number of computers and accesses using mobile broadband;

- significant increase in the speeds of broadband offers supported over fixed networks with the sale of products supported over optical fibre and coaxial cable distribution (DOCSIS3.0) networks, with speeds of 100 Mbps and higher;

- decrease in the number of accesses using unbundled loops in the context of the local loop unbundling offer (LLU) and exchanges with co-located operators;

- decrease in the number of accesses based on wholesale bitstream offers (Rede ADSL PT);

- discontinuation, in late 2010, by the main beneficiary operator of the LLU of its retail offers (including multi-play) supported on LLU. This operator now only has offers supported over its own network infrastructure, including optical fibre (the same operator has also withdrawn its broadband access retail offers supported on the "Rede ADSL PT" offer, which were typically provided in areas where it lacked network infrastructure, and replaced them with mobile broadband offers);

- growing demand for physical infrastructure access, including ducts in the context of the Reference Duct Access Offer (RDAO), with a view to the installation by other service providers (OSP) of their own optical fibre networks (fibre to the home - FTTH);

- accelerated development of high-speed access networks, involving at the end of 2010:

- 3.8 million dwellings cabled with cable networks (DOCSIS 3.0);

- 1.4 million dwellings cabled with FTTH;

- 278,000 residential customers of very high-speed networks (with services supported using FTTH or Eurodocsis 3.0 accesses);

- 3.8 million dwellings cabled with cable networks (DOCSIS 3.0);

- launch and respective award, as referenced in 4.1, of the public tenders for the construction, installation, financing, operation and maintenance of new optical fibre access networks, with co-financing, in 140 municipalities of the country with a lack of infrastructure and a lack of potential supply of advanced services;

- an agreement between Optimus and Vodafone Portugal to share next generation network infrastructure.

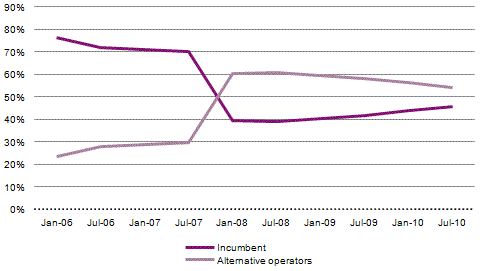

According to data from the Communications Committee (COCOM) with respect to broadband in the EU as on 1 July 2010, it appears that, overall, alternative operators in Portugal continue to have a greater number of fixed broadband accesses (lines) than the incumbent operator, PT Comunicações, S. A. (PTC), although the incumbent has been progressively regaining market share (see graph below).

Graph 1 - Fixed broadband accesses by operator

Source: COCOM 10-29 BB.

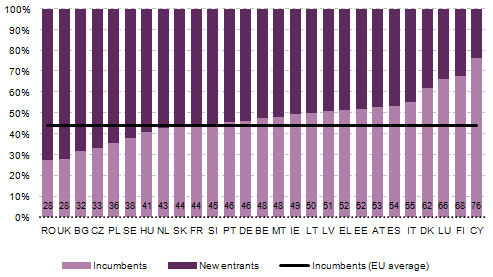

On the other hand, Portugal is one of those EU countries where alternative operators are focusing most on using their own infrastructure instead of using the infrastructure of the incumbent operator (which can be accessed through wholesale offers - e.g. LLU, ADSL Network) - see Graph 2.

Graph 2 - Fixed broadband accesses - market shares of incumbents

and alternative operators in different countries (July 2010)

Source: COCOM 10-29 BB.

The relevancy, in Portugal, of own infrastructure use by alternative operators - in addition to the ongoing structural separation of PT Multimédia (now ZON) and Portugal Telecom - results from the fact that Portugal has been a pioneer in making the incumbent subject to the obligation to provide its competitors with a duct access offer which enables them to expand their own networks much more cheaply than if they had to undertake construction work to install their own ducts.

According to the Country Report on Portugal in the 15th Implementation Report, published by the EC on 25 August 2010, the fixed broadband market in Portugal saw a growth rate last year in line with the EU, with broadband penetration reaching 18.6 percent (below the EU average of 24.8 percent). According to the report, the incumbent operator’s market share increased from 40.6 percent in January 2009 to 43.8 percent in January 2010, while alternative operators increased their market share of non-DSL accesses (from 39.7 percent to 41.4 percent) but saw a significant decline in their market share of DSL accesses (from 32.8 percent to 27.1 percent). The percentage of cable accesses (38.5 percent) remained stable.

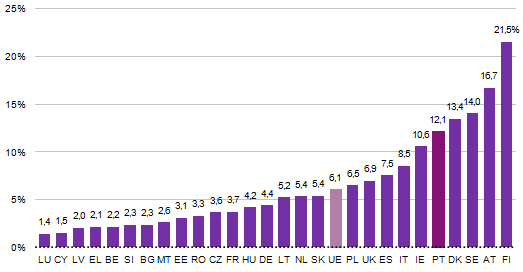

Even while fixed broadband penetration is lower than the EU average, Portugal is one of the countries where mobile broadband penetration is highest. According to COCOM, in July 2010, mobile broadband penetration in Portugal was 12.1 percent - the fourth highest in the EU27 (considering only cards and modems).

Graph 3 - Mobile broadband penetration - dedicated data

services - cards and modems (July 2010)

Source: COCOM 10-29 BB.

When it comes to penetration of next generation networks, according to the FTTH Council Europe, Portugal is at the top of the European Ranking of fibre optics in 2010, reinforcing its leading position and affirming the country’s role as a main driver of development and change in the sector in Europe".

In fact, according to data from the FTTH Council Europe, Portugal is one of five European countries with more homes passed with fibre, in addition to the significant coverage provided by cable distribution networks, updated with DOCSIS3.0 technology.

Portugal is the European country with the fifth largest absolute number of FTTH accesses, following Russia, France, Italy and the Ukraine, all much larger countries than Portugal. In 2010, Portugal was the European country with the largest absolute number of net additions of FTTH customers.

Markets of voice call termination on individual mobile networks

By determination of 18 May 2010, after receiving the opinion of Autoridade da Concorrência (the Portuguese Competition Authority), comments from the EC and the comments of interested parties in the context of a public consultation, ICP-ANACOM approved the final decisions on the definition of relevant markets for wholesale voice call termination on individual mobile networks, the assessment of SMP in these markets and the imposition, maintenance, amendment or withdrawal of regulatory obligations, as well as details of the implementation of the obligation to control pricing.

The decision on the market definition and analysis concluded that the product market consists of wholesale termination of voice calls in each of the existing mobile networks, encompassing termination on GSM and UMTS networks, while its geographical dimensions correspond to the dimensions of each of the networks of the active mobile operators.

Since each operator has a 100 per cent share in this market, as a monopolist in the offer of call termination on its own mobile network, there are high entry barriers that prevent other operators from offering competing services in the short term. Furthermore, there are no operators who carry sufficient countervailing power which might constrain the ability of mobile operators to act largely independently of their competitors, customers and consumers; As such, ICP-ANACOM considers that there is no effective competition in these markets. It is so concluded, as in 2005, that the three operators (TMN, Vodafone Portugal and Optimus) have SMP in their respective markets.

The obligations are also the same: (i) responding to reasonable requests for access; (ii) non-discrimination in the provision of access and interconnection and the respective provision of information; (iii) transparency in the publication of information; (iv) control of prices and costs accounting; and (v) separation of accounts.

The analysis made in 2005 and 2008 of the identified competitive problem (related to the imbalance in traffic and the tariff differences between on-net and off-net calls) concluded that problems remain, despite the contribution made by ICP-ANACOM's intervention in July 2008 to increased competition and benefits for end-users; this underscores the need for further reduction in mobile termination rates, and in this context it was decided to implement a gradual reduction in the maximum prices charged for voice call termination on mobile networks by three mobile operators notified as having SMP. This reduction began in May 2010, and is due to reach 0.0350 per minute on 24 August 2011.

ICP-ANACOM’s intention is to bring termination rates into line with the cost of the service, aiming to reduce competitive distortions between (i) fixed and mobile operators and (ii) mobile operators of different sizes, and the decision took account of developments occurring internationally, the evolution of operator behaviour in the retail market, and a benchmarking assessment.

ICP-ANACOM also considered that there were grounds for the continued application of symmetrical pricing, as already established and in force since October 2009, throughout the period of the decision's application, in accordance with Community recommendations. The position was taken that the benefits to competition and for end-consumers resulting from the application of these new prices would be significant in itself and that no further extraordinary action was warranted.

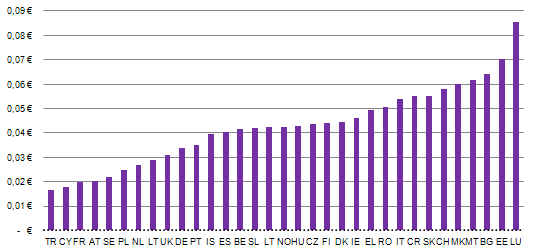

As mentioned, this decision took international developments into account, notably EC Recommendation published on 7 May 2009 on the regulatory treatment of fixed and mobile termination rates in the EU. The document proposes the adoption of symmetrical termination rates based on the costs of an efficient operator, using a Pure LRIC model, until 31 December 2012. The graph below shows an estimate of average termination prices in November 2011, showing Portugal in 11th place among 33 countries ranked by lowest price.

Graph 4 - Estimated average price of termination in November 2011

Source: ICP-ANACOM, notifications and decisions of European NRA.

Estimating the effects of its decision on consumers, ICP-ANACOM concluded that the reduction in mobile termination prices, bringing them into line with efficient costs, will lead to a gradual convergence between these prices and the prices of fixed termination, whose differentiation (at the time of the decision, was about 10 times) is a cause of strong competitive distortions. It should be noted that these differences result in a net annual transfer of about 67 million from fixed networks to mobile networks. The elimination of these distortions is crucial given the current trend in electronic communications markets towards increasing convergence between networks and between services. Such convergence products will only be developed, for the benefit of consumers, if termination rates on fixed and mobile networks are more aligned.

ICP-ANACOM has estimated that consumers will benefit from the decision to control prices in two distinct ways. Since this Authority regulates the retail prices of PTC (with a significant market share) and other operators would tend to follow the reduction of the incumbent for competitive reasons, it was considered that consumers would derive a benefit of 30 million euros in fixed-mobile communications during the six quarters of this decision.

On the other hand, consumers would also benefit from the increased competition that would result from the reduction in the competitive distortion seen in the mobile communications market due to the existence of inefficient transfers between operators of different sizes. Using a working assumption adopted by the Commission in the Recommendation on terminations, ICP-ANACOM estimated this benefit at 24 million euros 1 for the considered period of six quarters. Total gain for consumers is therefore estimated at around 54 million euros.

This decision will be reviewed in 2011, taking into account the results of the costing model, based on the methodology contained in the Recommendation on Terminations of 7 May 2009, which is under development.

Leased lines markets

On 28 September 2010, ICP-ANACOM approved the final decision on the definition of product markets and geographic markets, assessment of SMP and the imposition, maintenance, amendment or withdrawal of regulatory obligations in relation to the market for the retail provision of leased lines and markets of wholesale terminating and trunk segments of leased lines 2.

In this decision, ICP-ANACOM concluded that the retail market for leased lines is not a relevant market susceptible to ex-ante 3 regulation and, consequently, all obligations previously imposed on Grupo Portugal Telecom (Grupo PT) in the context of this market were withdrawn.

With regard to the market for wholesale terminating segments, the main findings included in the decision were:

- For the purposes of ex-ante regulation and, in accordance with the principles of competition law, the market of wholesale terminating segments of leased lines (access to end-customers), irrespective of the technology and of capacity, encompassing the entire national territory, was identified as relevant;

- Grupo PT was designated as having SMP on this market, whereby the following obligations were imposed: access to and use of specific network resources, non-discrimination in the provision of access and interconnection and in the respective provision of information, transparency in the publication of information, including the publication of reference offers, separation of accounts for specific activities related to access and/or interconnection, control of prices and cost accounting and financial reporting.

With respect to the market of wholesale trunk segments of leased lines, the main conclusions were as follows:

- the existence of heterogeneous competitive conditions in two different sets of routes identified justified the definition of two distinct, geographic markets:

- market of wholesale trunking segments without distinction of capability and technology, consisting of "Routes C" - covers routes which connect the main urban centres (and within urban centres, especially the metropolitan areas of Lisbon and Porto) with greater population and corporate density and where there are various competing alternative network offers;

- market of wholesale trunking segments of leased lines irrespective of capacity and technology, consisting of "Routes NC" - covering routes linking areas of lower population and corporate density and where, in most cases, only the incumbent operator is present (and, in these cases, obviously, with a market share of 100 percent).

- market of wholesale trunking segments without distinction of capability and technology, consisting of "Routes C" - covers routes which connect the main urban centres (and within urban centres, especially the metropolitan areas of Lisbon and Porto) with greater population and corporate density and where there are various competing alternative network offers;

- for the purposes of ex-ante regulation and in accordance with the principles of competition law, the wholesale market for trunking segments irrespective of capacity and technology, consisting of "Routes NC" was identified as relevant.

- Grupo PT was designated as having SMP on this market, whereby the following obligations were imposed: access to and use of specific network resources, non-discrimination in the provision of access and interconnection and in the respective provision of information, transparency in the publication of information, including the publication of reference offers, separation of accounts for specific activities related to access and/or interconnection, control of prices and cost accounting and financial reporting.

- For the purposes of ex-ante regulation, the wholesale market for trunking segments irrespective of capacity and technology, consisting of "Routes C" was not identified as relevant, whereby all previously imposed obligations were withdrawn.

In practice, the main changes over the current situation include the regulation of circuits supported on Ethernet technology and deregulation of the retail market of leased lines and of a determined set of routes (trunk segments).

In 2010, following this market analysis of leased lines, on 6 December 2010, PTC issued the ECRO, which will be analyzed by ICP-ANACOM in 2011 and, where appropriate, made subject to regulatory measures designed to ensure compliance with applicable regulatory principles.

1 For this calculation, use was made of the same assumptions as used by the EC in the models considered in the document ''Implications for Industry, Competition and Consumers''. The EC assumes, in this context, that the mobile operators will transfer one-third (0.33) of the changes in the terminations rates of mobile-mobile calls to consumers, a figure which, although while it may be reduced, is assumed considering the fact that retail markets are today already very competitive.

2 Only the market for wholesale terminating segments was identified as a relevant market in the EC Recommendation on relevant markets (market 6 of Recommendation 2007/879/EC of 17 December). The market of retail leased lines and the market of wholesale trunk segments of leased lines correspond to markets identified in the previous Recommendation (markets 7 and 14 of Recommendation 2003/11/EC of 11 February).

3 This conclusion is aligned with the EC Recommendation on relevant markets.